We exclusively execute cyber insurance, and we do it with passion, care and unbeatable attention to detail. Cyber doesn’t fit the traditional insurance model, it isn’t a conventional risk, so it shouldn’t be treated like one.

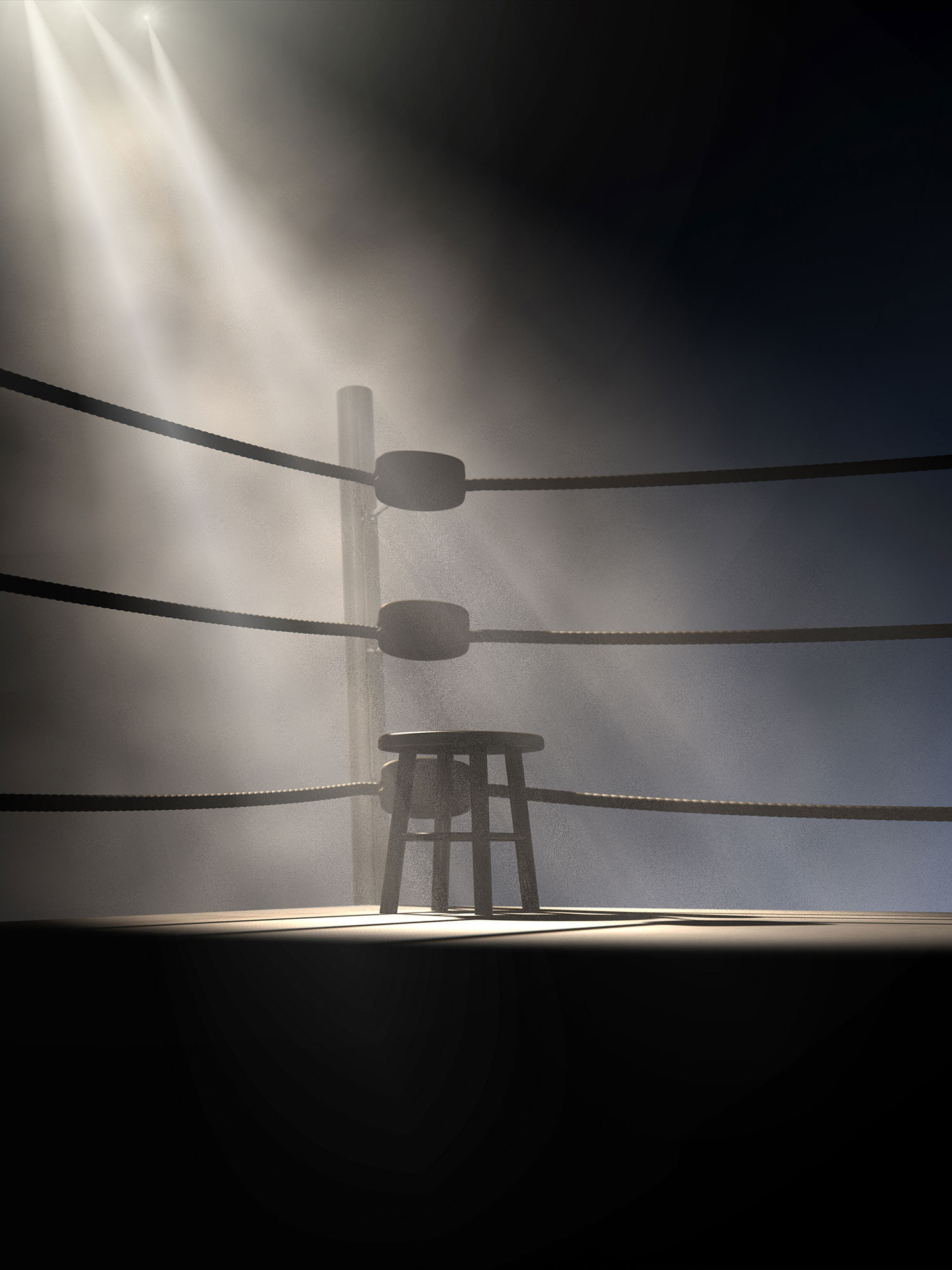

Challenging the

status quo.

We take pride in getting to know our clients and their businesses and we ask the right questions in order to match them to the perfect policy (yes, that means one that will actually pay out). But that’s just the beginning.

We consult with our clients to arm them with the knowledge and expertise they need to exude cyber confidence in the Boardroom, and we’re always in their corner ready to respond on what could well be the worst (professional) day of their life.

Superficially it might seem like none of this is rocket science – and yet, to date, it is basically unheard of.

Analysis

We conduct in-depth conversations and analysis of an organisation’s cyber risk. We identify their ‘crown jewels’ and work out what level of cover is appropriate, tailored to the needs of each individual client.

Communication

Cyber is a consistently evolving space and we need to keep our clients at the forefront of the industry, which is exactly where we sit. Our skill lies in aligning an organisation’s changing business with the changing cyber landscape and the changing demands of the underwriters.

Price

There are three key routes to a competitive price in cyber. Never rush the renewal; only buy the elements of cover that are required; and ensure the technical submission is as thorough as possible. These three elements are fundamental to our broking process.

Comprehension

For a cyber policy to be relied upon, it has to be understood. We break down the policy into its key coverage areas, translating cyber and legal talk into plain English, and ensuring that each component is relevant and needed.

Planning

The key to successful incident response is to plan ahead. We consider the ‘before’ and the ‘after’ parts of incident response crucial and give the forethought and planning the time and resources it deserves.

Appraisal

In order to achieve cover, organisations will need to submit the blueprint of their IT estate. We are perfectly placed to offer guidance on areas of particular underwriter focus, ensuring premiums are not unnecessarily raised or that cover limits are reduced.

Different, but not just for the sake of it.

The role of the broker hasn’t changed for years. The broker relays the perceived risk of the client to the underwriter, the underwriter comes back with prices, and the broker relays the prices back to the client. Rinse and repeat.

Assured acts as more of a consultancy than a brokerage. Although we earn our fee through the traditional method of broking, we deliver our long-term value through the work we deliver during the tenure of the policy.

Our process is designed to ensure that the policy is the right one for their business, actually covers what they need, and ensures they are properly prepared for if, and when, any incident arises.

“An insurance policy will only comprehensively match and support an organisation’s cyber risk if a specialist has curated it. Hello, nice to meet you; we are that specialist…”

— Henry Green, Founder

Frequently asked questions

We invest a lot in cybersecurity. So why do we need cyber insurance?

It shouldn’t be an either/or. In fact, to get cyber insurance, a demonstration of solid cybersecurity practice is required. But no security is 100%, and every business deserves the opportunity to invest in a backstop or security blanket to get back on its feet and return to the position it was in before it suffered a cyber attack or breach.

How do I know if my organisation needs cyber insurance?

It sounds simple, but it comes down to risk. Identify your crown jewels and what needs protecting, calculate the cost of downtime if your business is attacked and debilitated, and determine what support you need. It’s likely that if you operate any part of your organisation digitally or if you store sensitive data, cyber insurance could be fundamental to protecting your business.

Why would I choose Assured over the more established brokers?

We exclusively broke cyber insurance and thus are not distracted by other commercial insurance lines. We channel all our effort and passion into cyber, sitting confidently at the heart of the cyber industry. Because we ‘get it’, we live in the small print of a policy so our clients don’t have to. The value we offer far exceeds just the policy. Check out ‘how we work’ to learn more.

Does cyber insurance cover ransomware?

Insurance is available to cover a business for the loss it might incur from a ransomware event. However, like many lines of insurance, an organisation must meet specific security controls before this is offered. Most importantly, cyber insurance gives you access to a panel of incident responders who help deal with the crisis surrounding a ransomware event, giving you both protection and, most notably, options.

Is there an additional risk in introducing another broker?

Working with two brokers is easy when the process is smooth. If you had to claim under a cyber policy and a Directors & Officers policy, you would still have to provide two separate sets of information to two different insurers, even if you were using one broker. From a time and effort perspective, there is no difference. From a value perspective, there’s a huge difference.

Do I get a better price from the underwriter by keeping all insurance lines together?

The answer is no. Cyber is priced as its own risk and will represent the size and activity of your business, regardless of whether it is insured ‘all together’ with other coverages. You cannot rely on another form of insurance (such as professional liability) to cover you for cyber incidents unless it affirmatively states that it is covered within your policy wording. By keeping all insurance lines together, you lose out on the expertise, guidance and invaluable advice you can get from a specialist cyber broker.

Assured Intelligence

Blogs & Opinions 25.07.2024

The Labour Party Promised Change: What Does That Mean for Cyber?

The Labour government promised “change” as its big election manifesto theme. Will that stretch to cyber?

Features 23.07.2024

Ransomware Glow Ups: The Ransomware Groups That Have Reinvented Themselves

Ransomware groups often rebrand, resurfacing with a new identity. Kate O’Flaherty explores what this means for law enforcement and lists the most significant ransom group rebrands Ransomware never goes away, nor do the groups that use the data-locking malware in attacks. Despite multiple initiatives, sanctions, and attempts by law enforcement to make arrests, ransomware groups […]

Blogs & Opinions 18.07.2024

How CISOs Can Navigate Legal Risk and Accountability

CISOs are often stretched thin, often without the same protections as other executive team members.